China has begun educating its billions of users and potential buyers in tap payments for the first time. This latest move comes from Alipay (Alibaba), one of the two major internet payment giants in the country, alongside WeChat Pay by Tencent. Here’s the gist of it!

From QR codes to tap payments in 2024

Over a decade ago, China transitioned from cash to QR code payments as an easy way for offline stores to accept payments and for millions of customers without credit cards to purchase goods and services. In China, your phone number serves as your identifier, and through mobile and SMS verification, a world of services and products becomes accessible. Almost everyone, regardless of age, owns a smartphone with WeChat and Alipay applications installed.

POS systems, which allow merchants to process card payments electronically, have been largely absent in many small businesses and street vendors in China. QR codes were far easier to create and use, making them popular among small shops and street vendors who couldn’t afford POS systems or accept credit cards. In reality, credit cards never really took off in China.

Users in China can simply tap the Pay/Receive option in their Alipay app to generate a dynamically refreshing QR code. Every shop has a QR code scanner and when you pass your code, the merchant accepts the payment. Alternatively, users can scan a QR code printed on paper, enter the amount, and pay—ideal for street vendors and small sellers without POS systems. Check a day in my life in China back in Covid times.

Many of us in Europe and the tech world were fascinated by QR codes in the past, wondering how we could integrate them into our own systems or connect the offline with the online world. However, Europe never fully jumped from cash to mobile payments; instead, the adoption of cards was gradual and accelerated over the years. Wallets like Google Pay and Apple Pay have naturally replaced physical cards, and let’s be honest, the user experience of tapping is much faster and better than generating a code, passing the phone to a scanner, and waiting a few seconds for acceptance. In a country where millions of people queue daily to make payments, every second counts.

China opening up to the world

It’s no secret that China is ramping up measures and policies to achieve its growth targets for 2024 and stimulate growth for 2025 and beyond. Among its latest initiatives are measures to make it easier for foreign companies to invest in China and visa-free policies extending to Europe. Logically, the next step is to make it easier for foreign individuals and companies to spend money in China.

POS systems have started appearing in taxis and shops where they were previously rare. In recent weeks, I noticed new POS machines at Manner, my local favorite coffee shop. I thought, “Weird, are they accepting cards? What the heck is this Alipay tap thing?”

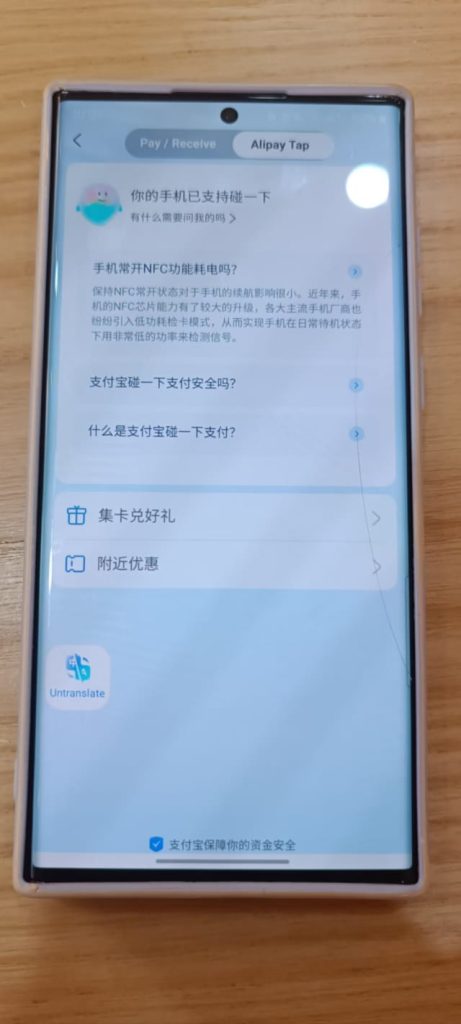

Shortly after, I noticed the new tap-to-pay option on my Alipay. Now, you can tap to pay with Alipay—no more opening codes or scanning. Did I mention that a few months ago, both Alipay and WeChat opened up to accept foreign cards?

While I’m not an expert in payment software, it’s clear that Alipay is moving towards tap payments, mimicking the tap-to-pay behavior of credit cards. Forget about technology for a moment and focus on behavior and habit formation. There’s a whole strategy behind opening up payments, educating users, and matching the user experience of the West. Alipay, and consequently China, has a clear strategy, path, and OKRs to open up its economy to the world, and this is just the beginning.